What is a Scam?

Scam (definitions)

Source: https://dictionary.cambridge.org/dictionary/english/scam

noun [ C ]

UK

/skæm/ US

/skæm/

a dishonest plan for making money or getting an advantage, especially one that involves tricking people:

- Banks often carry information about email scams on their websites.

- To avoid scams, never sign things in a hurry.

- an insurance scam, etc.

Examples:

- There was an investigation to see who was behind the scam.

- Many travellers have fallen victim to the scam.

- There are a lot of online stores, and some of them are scam sites.

————————————————————————————-

Scam

noun [ C ]

infml

US

/skæm/

a dishonest or illegal plan or activity, esp. one for making money:

She was involved in an insurance scam, collecting on false accident claims.

(Definition of scam from the Cambridge Academic Content Dictionary © Cambridge University Press)

———————————————————————————————————————-

Scam

noun [ C ]

informal

UK

/skæm/ US

an illegal way of making money, usually by tricking people:

———————————————————————————–

What are some common types of scams?

LAST REVIEWED: AUG 28, 2023

Source: https://www.consumerfinance.gov/ask-cfpb/what-are-some-common-types-of-scams-en-2092/

Scammers are constantly finding new ways to steal your money. You can protect yourself by knowing what to look out for.

Common types of fraud and scams

Here are some of the most common types of fraud and scams. Learn what to watch for and what steps to take to keep yourself, your loved ones, and your money safe.

Charity scams

A charity scam is when a thief poses as a real charity or makes up the name of a charity that sounds real in order to get money from you.

These kinds of scams often increase during the holiday season as well as around natural disasters and emergencies, such as storms, wildfires, or earthquakes. Be careful when any charity calls to ask for donations, especially ones that suggest they’re following up on a donation pledge you don’t remember making.

What to do: Ask for detailed information about the charity, including address and phone number. Look up the charity through their website or a trusted third-party source to confirm that the charity is real. Learn more about how to avoid a charity scam.

Debt collection scams

Most debt collectors will contact you to collect on legitimate debts you owe. But there are scammers who pose as debt collectors to get you to pay for debts you don’t owe or ones you’ve already paid.

What to do: Don’t provide any personal financial information until you can verify the debt. You can use this sample letter to request more information. Read more about the warning signs.

Debt settlement and debt relief scams

Debt settlement or relief companies often promise to renegotiate, settle, or in some way change the terms of a person’s debt to a creditor or debt collector. Dealing with debt settlement companies, though, can be risky and could leave you even further in debt.

What to do: Avoid doing business with any company that guarantees they can settle your debts, especially those that charge up-front fees before performing any services. Instead, you can work with a free or nonprofit credit counseling program that can help you work with your creditors. Learn more about the risks of working with a debt settlement or relief company.

FDIC logo misuse

The FDIC logo is displayed on buildings, websites, advertisements, and other materials from its member banks. Sometimes, a scammer displays the FDIC logo, or says its accounts are insured or regulated by the FDIC, to try to assure you that your money is safe when it isn’t. Some of these scams could be related to cryptocurrencies.

What to do: You can double-check whether the business is an FDIC-insured bank by using the lookup page on the FDIC’s site, called BankFind .

Foreclosure relief or mortgage loan modification scams

Foreclosure relief or mortgage loan modification scams are schemes to take your money or your house, often by making a false promise of saving you from foreclosure. Scammers may ask you to pay upfront fees for their service, guarantee a loan modification, or ask you to sign over the title of your property, or sign paperwork you don’t understand.

What to do: If you are having trouble making payments on your mortgage, a HUD-approved housing counseling agency can help you assess your options and avoid scams. If you think you may have been a victim of a foreclosure relief scam, you may also want to consult an attorney. Learn more about mortgage loan modification scams.

Grandparent scams

If you get a call from someone who sounds like a grandchild or relative asking you to wire or transfer money or send gift cards to help them out of trouble, it could be a scam.

What to do: Read more about other ways to protect older adults from fraud and financial exploitation.

Imposter scams

Imposter scammers try to convince you to send money by pretending to be someone you know or trust like a sheriff; local, state, or federal government employee; or charity organization.

What to do: Remember, caller ID can be faked. You can always call the organization or government agency and ask if the person works for them before giving any money. Read more about imposter scams.

Mail fraud

Mail fraud letters look real but the promises are fake. A common warning sign is a letter asking you to send money or personal information now in order to receive something of value later. Examples of mail fraud might include notices of prizes, sweepstakes winnings, vacations, and other offers to claim valuable items.

What to do: The USPS has identified common postal or mail fraud schemes. If you’re a victim of mail fraud, you can file a complaint through the U.S. Postal Inspection Service .

Money mule scams

A money mule is someone who receives and moves money that came from victims of fraud. While some money mules know they’re assisting with criminal activity, others are unaware that their actions are helping fraudsters.

Money mules may be recruited through online job or social media posts that promise easy money for little effort. They may also agree to help a love interest who they’ve met online or over the phone, by sending or receiving money, as part of a romance scam.

What to do: Don’t agree to receive or send money or packages for people you either don’t know or haven’t met. Also, be aware of jobs that promise easy money. Learn more about the red flags and what to do if you’re a victim of a money mule scam.

Money transfer or mobile payment services fraud

Con artists use money transfers to steal people’s money. If someone you don’t know asks you to send money to them, it should be a red flag. Scammers also use mobile payment services to trick people into sending money or merchandise without holding up their end of the deal. For example, a scammer may sell you concert or sports tickets but then never actually give them to you. Or a scammer might purchase an item from you, appear to send a payment, and then cancel it before it reaches your bank account.

Using mobile payment services with family, friends, and others you know and trust is the safest way to protect your money. You should also be cautious when people you do know ask you to send them money. Before you send money, verify that they are the ones requesting it.

What to do: Never send money to someone you don’t know. If you think you made a money transfer to a scammer, contact your bank or the company you used to send the money immediately and alert them that there may have been a mistake.

Mortgage closing scams

Mortgage closing scams target homebuyers who are nearing the closing date on their mortgage loan. The scammer attempts to steal the homebuyer’s closing funds—for example, their down payment and closing costs—by sending the homebuyer an email posing as the homebuyer’s real estate agent or settlement agent (title company, escrow officer, or attorney).

What to do: These schemes are often complex and appear as legitimate conversations with your real estate or settlement agent. When you’re about to close on your home, take several steps, including identifying trusted individuals to confirm the process and payment instructions and writing down their names and contact information so you can reach out to them directly. Learn more about what steps you should take to help protect your closing funds.

Lottery or prize scams

In a lottery or prize scam, the scammers may call or email to tell you that you’ve won a prize through a lottery or sweepstakes and then ask you to pay an upfront payment for fees and taxes. In some cases, they may claim to be from a federal government agency.

What to do: Avoid providing any personal or financial information, including credit cards or Social Security numbers, to anyone you don’t know. Also, never make an upfront payment for a promised prize, especially if they demand immediate payment. Learn more about lottery or prize scam red flags.

Romance scams

A romance scam is when a new love interest tricks you into falling for them when they really just want your money. Romance scams start in a few different ways, usually online. Scammers may also spend time getting to know you and developing trust before asking you for a loan or for access to your finances.

What to do: Be smart about who you connect with and what information you share online. Don’t share sensitive personal information, such as bank account or credit card numbers or a Social Security number, with a new love connection. Learn more about how to avoid romance scams.

Common payment methods used by scammers

Never send money to someone you don’t know. Scammers use a variety of ways to collect money from you, including:

- Wire transfers

- Person-to-person payment services and mobile payment apps

- Gift cards

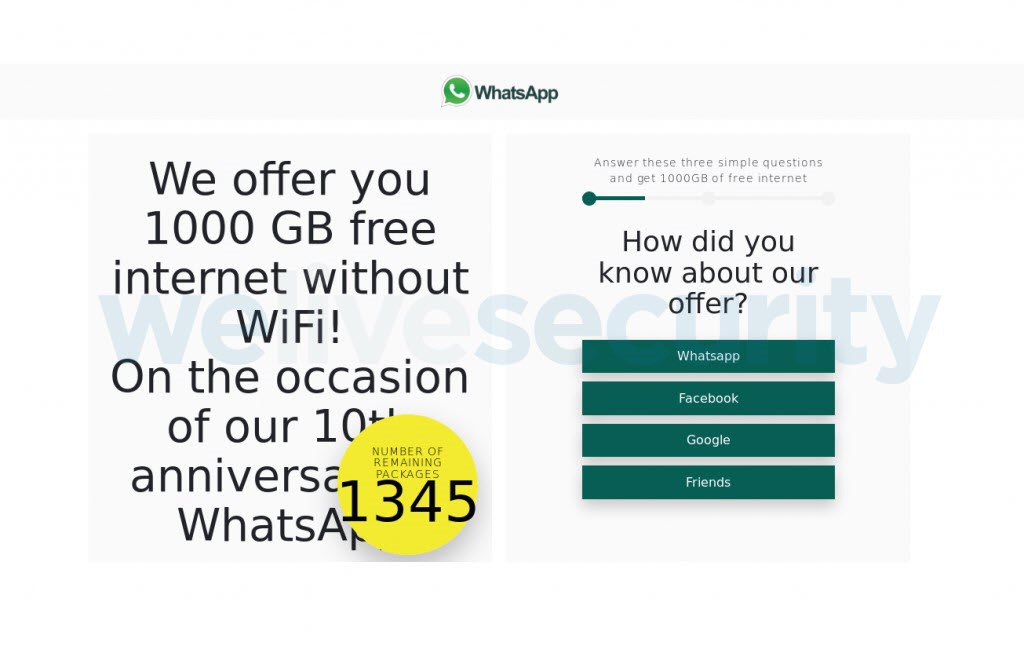

SCAMS

10 reasons why we fall for scams

The ‘it won’t happen to me’ mindset leaves you unprepared – here are some common factors that put any of us at risk of online fraud.

Source: https://www.welivesecurity.com/2022/05/12/10-reasons-why-we-fall-scams/

12 May 2022 • 4 min. read

Source: https://www.welivesecurity.com/2022/05/12/10-reasons-why-we-fall-scams/

Sometimes you need to say things that go without saying: The internet has revolutionized our lives, changing the way we work, learn, entertain ourselves and interact with each other. The benefits of our wired world are manifold, but so are the risks – including the risk of falling victim to a scam.

Fraud has, of course, existed in various shapes and sizes for many, many years. However, the internet has given new life even to age-old schemes, vastly expanding the opportunities, and especially the number of potential targets, for scammers.

What’s more, scams are growing in sophistication and none of us is immune to any of the various flavors of online schemes that have proven their staying power. The more venues we use to enjoy the advantages of the internet, the more opportunities for fraudsters to explore and exploit, be it for inheritance scams, various types of shopping cons, bogus job offers, fake sweepstakes and lotteries, and even dating fraud, to name just some of the most common scams doing the rounds.

But if we know this, why do we keep getting sucked into these ploys? Let’s look at some of the most common reasons why the various tricks and social engineering methods aimed at parting us from our money are so effective.

· Cumulative knowledge pays off

First off, many schemes have been around for a long time, so there’s a kind of cumulative knowledge that is passed on to the “next generation” of tricksters. The tried-and-tested techniques and personas are often built meticulously and many phishing emails are crafted so you don’t notice that something is amiss – at first glance, anyway.

· Our digital “breadcrumbs” are used against us

Some scammers will use all available and seemingly harmless data about you to their advantage, watching your every move online, typically on social media, in order to eventually exploit your digital footprint. Unless you’re careful, the more you interact online, the higher the odds that they’ll know a lot about you – ultimately, they may have an easier time duping you.

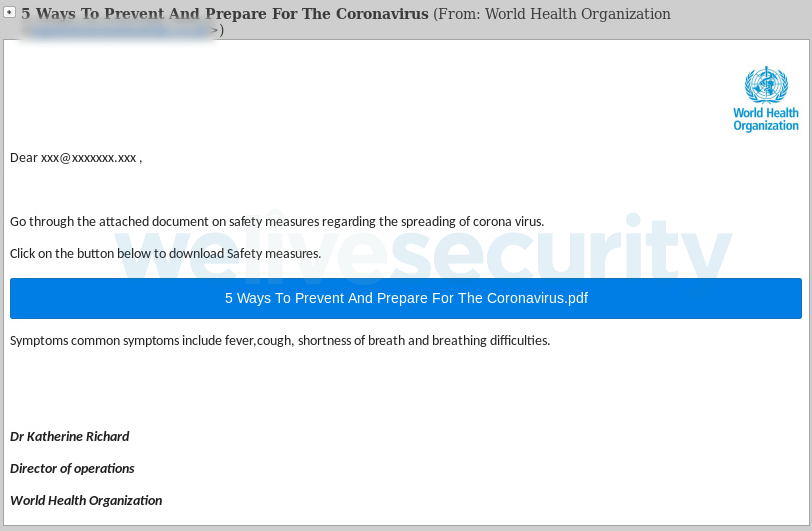

· Scammers are good storytellers

Many con artists can create plausible stories and personas that may not always trigger your spam filters. Likewise, they’re quick to exploit current events for their own gain, including by taking advantage of fears surrounding public emergencies.

· We’re in a hurry

Scammers pressure you to act now, they don’t want you to think things through. A prize will be a limited time offer and a bill will be due on the same day, to name just some examples where you’re being rushed into taking some action. You might then just pull the trigger without considering the full picture and verifying if the message is legitimate. Remember to pause and think before taking any decisions.

· Everybody loves a free lunch

Exploiting your financial difficulties or just a plain desire for easy cash, many schemes start by offering fake freebies or involve promises of sky-high investment returns. How could you turn this down, right?

· We’re hardwired to obey authority

People tend to trust those in positions of authority. Fraudsters often impersonate people who hold some kind of expertise: a government worker, a lawyer, a company executive or an expert in a specific field. These are all people we were taught to trust. Scammers will try to look official and use the names of companies or organizations you might recognize.

· We may be distracted

Scams are increasingly frequent, and it may happen that someone tries to scam you on a day when you feel ill, tired or otherwise vulnerable. As you’re concerned with more important things, you may pay less attention to details, opening the door to possible risks. Fraudsters can even perceive and take advantage of your vulnerability.

· Scammers are focused

And they may be one step ahead. While you’re trying to figure out if a phone number calling might be legit, they’re already taking over your mind, as it were.

· We like to help

Ploys that involve requests for help create empathy with the scammer or with the people who the fraudster claims to represent. For example, narratives of personal tragedies or public emergencies remain effective. Even if in the back of your mind you know it might not be true, you are still inclined to help “just in case”. Scammers realize that people want to feel useful.

· Scammers have “empathy”

If you happen to interact with, say, a romance scammer, typically via messages, they may spend a while grooming you to gain your trust, making you feel understood and even test how far they can go with you.

What to do if you get scammed:

- If it is a scam on social media, contact their support centre; if it is a shopping scam, contact the service provider to denounce the scam and ask for help.

- If there’s money involved, call your bank and let them know. This is especially helpful when it comes to recovering money thought lost.

- Don’t make any payment in order to win a “prize”.

- If you’re told about future financial gains on the stock market or from a Bitcoin project, don’t pay your “taxes” beforehand.

- Change all your passwords in case the scammer has your personal details.

- Check your privacy settings on social media. Limit who can tag you on photos and comments.

- Report the scam to the relevant authorities. For example, in Europe you can start by visiting the Cyber First Aid website, in the US on the website of the Department of Justice.

In closing, never assume you can’t fall victim to a scam. Fraud may happen to anybody regardless of how tech-savvy and smart they are.

Now, a note from this author:

We live in a world 0f rapid modernisation, great scientific advancements and in an ever-evolving age of the mighty Internet and Digitalisation. Yet, it is equally true that these very scientific advances themselves have gone against humanity – robots have replaced humans and AI (Artificial Intelligence, ChatGPT, etc.) have collectively caused tremendous job layoffs worldwide, in the thousands and millions, in contemporary times. If a computer can effectively do the work of a human being, why would a person be needed to do the job at all? Corporate giants have reduced their workforce by more than half of its original size. Job layoffs have unfortunately become the norm of the day. Can you imagine that the previous day an individual was feeling happy and secure in having a job and a regular income, but the next day when he/she arrives at the office, the HR hands in a pink slip to him/her – a job termination notice stating that he/she has either been laid off or fired from the job? Being forced to accept a pink slip, whether with or without a warning, takes a huge toll on one’s system – the unprecedented stress opens various avenues leading to serious health problems such as hypertension, diabetes mellitus and clinical depression, mood swings, etc. among many other grave health issues. Whether people have been leading an ‘over-the-top’ extravagant lifestyle or not, the sudden loss of a regular income causes a huge toll on one’s fast-diminishing bank account balance. Rampant unemployment causes people to become desperate. Desperation calls for desperate measures.

The biggest joke on mankind, in contemporary times, is that the computer asks the human being to confirm whether he/she is a robot or not. It not only sounds ridiculous and incredible; it is totally absurd and fantastic to even imagine such a scenario as being possible. However, it has become a reigning fact of life gaining momentum as each day passes by – it has become a very sore point, to say the least. Computers are ruling the world nowadays – humanity has diminished in stature to becoming only a by-product of it.

Such a bitter pill to swallow for humanity! Scientists and computer engineers have toiled hard and long; used their zeal, enthusiasm, intelligence, time and effort to create computers so that it would make work more effective and less time-consuming – and it did, for a while. But then, just like a race against time, computers have rapidly gained speed and momentum till they have overrun, overtaken and outpaced the human horse rider (so to speak) at the lead position. The computer wins; the human being is left far behind. There’s no competition at all – what a sad situation!

Computers are just one aspect in the wider world of Machines – there are machines for anything and everything nowadays – starting from the humane, mechanised slaughter of animals for meat consumption, to an industrial-sized flour kneader, bread maker and vegetable peeler and chopper – these actions occurring in perfect mechanical sync before the peeled and cut vegetables are sent onward on a mechanised, moving conveyor belt for tinning and labelling purposes, by the machine itself. In mass-production factories such as this, the need for human intervention – except for operating the machines – is becoming less and less, till one day, it will become negligible or even non-existent. Except for the expression and mimicking of human emotions like kindness, compassion, etc., a machine can do anything that it has been programmed to do. Computers are taught to think like people, but they lack the reasoning and logical power of thought of human beings. Human beings can discern what is Right and Wrong – they can make ethically and morally right decisions – if they want to.

Surely, it is no doubt then that human beings are their own worst enemies. It is for this express reason that we are moving at breakneck speed in a downward spiral, into a bottomless abyss of hell. We have fought against and defeated ourselves and continue blindly doing so. When will this lunacy stop – if ever?

To make the already tainted and murky waters of the current ‘jobless situation’ darker and slimier, is the global population boom. When the population worldwide is mushrooming unrestrained – daily – at such an alarming rate, where will there ever be enough jobs for people? Naturally, this implies that there are much fewer jobs than there are people. An idle mind is the devil’s workshop. When people are stuck at home and find themselves at loose ends, what better way is there for them to pass the time than to have sex? It may sound funny, but it really isn’t. Sex implies procreation and people are having babies, by the dozens, just because they have the capacity to do so. Welcome to the world of the Baby Boom!

To compound this problem of computers taking over the rule of the world, is the rapid emergence and critical importance of the Internet, Digitalisation, and its strong online presence. Anything and everything can be done online nowadays – whether it be online payments or online shopping. The list is endless. Who needs a book library of encyclopaedias and literature when e-books and the Amazon Kindle experience have replaced them so effortlessly? If a book library is not needed; then the human librarian is not needed either. If a computer can do the job of a banker or a cashier 9for e.g. an ATM cash withdrawal machine), why ask a human to do it? If the artificial intelligence of a computer can shortlist job applicants from a lengthy ream of people, what need is there to have job recruiters and a Human Resources Team?

The ease and convenience of the online shopping experience has eased out the need for the small businessmen, retailers, and distributors. Most people nowadays own washing machines and dryers, so the proverbial ‘dhobi’ (washerman who also irons the washed garments) finds himself out of a job. Traditional jobs like those of the carpenter, cobbler, milk delivery man and postman are rapidly going out of existence. Readymade furniture and machine-made shoes are readily available. Milk cartons can be easily ordered online for free home delivery – currently by a person but the latter will soon be replaced by a robot. In the digital age, where the use of paper is becoming less and less, how much mail can a postman bring to your doorstep? Very little – if at all. Online shopping sites will soon replace delivery boys with cost-effective robots. If a machine can do the same job as efficiently and as faultlessly as a human being, why have a person involved at all?

We live in desperate times – people have no money to feed their families, leave alone themselves. People will do anything to earn a “quick buck” – whether it be via fair means or foul. Since no one ever earned money without toil, diligence and the expense of time, energy and effort, the only way forward, is by earning money via unfair means. The warped thinking of such people justifies such cunning and deviousness. In this way, “the Vast and Ever-Evolving Kingdom of Scams” started – the gigantic, ominous world of shadowy conmen and ingenious fraudsters.

Until such time as the world’s governments impose stringent controls on the steep rise in the population of their respective countries globally, there will always be ‘tons’ more people than there will be jobs available.

The Corona Virus Pandemic brought the entire world to a standstill – can you even imagine that a microscopic, deadly virus is holding our entire planet to ransom? During this time, while in Nature, this lockdown symbolised new beginnings, new growth of lush green trees and the rejuvenation of plants and forests; for human beings, it sounded literally (and figuratively) a death knell. For the majority of the world’s people, the pandemic spelled the beginning of their downfall – it was truly a horrific time to live through. People lost their lives in the flick of an eye, and they suddenly lost their livelihoods and regular source of income in the millions, across the globe.

Till this very day, we hear of job layoffs in the thousands – people are losing their jobs literally on a daily basis. Small and large businesses have incurred great losses because of various online transactions that are easily available for use nowadays. The Internet has taken over the World.

The Internet which started out as being a great boon for humanity has become our greatest enemy – we live in an era where Artificial Intelligence and the use of various machines reigns supreme. It was human beings that created this scenario in the first place and now the world of computers and mechanisation is having the Last Laugh at our expense.

Just because thousands of people are using their intelligence in the wrong way and resorting to scams and fraud to earn quick money without too much expense of time, effort and energy, does NOT make such behaviour ethically correct or morally right. People have become increasingly greedy, and it is their lust for quick gains that has led to this miserable situation. Dishonesty, cunning and deviousness will have its downfall – if not today, then some other day, for sure. These sly, ruthless and unscrupulous people care for nobody but themselves. Scamming and defrauding people is neither justifiable nor excusable, considering the current circumstances that we live in. Conning innocent people is a despicable act of evil that is neither acceptable nor tolerable in any well-regulated society.

People who ‘Fall for the Con’ are inadvertently furthering the rise in extremely elaborate scams and ingenious frauds engineered by idle, yet intelligent-minded conmen, fraudsters and confidence-tricksters. The latter are getting more and more brazen because they have realised just how easy it is to trick people – especially by preying upon their vulnerabilities and weaknesses.

If something (or someone) gives the distinct impression of being ‘too good to be true’, then it truly IS too good to be true. Learn to trust your gut instinct – your inner voice of reason. The latter is rarely – if ever – wrong. Learning to trust our gut instinct protects us from harm. It forewarns us before we fall into an inextricable trap.

Appearances can be Deceptive. Nobody can trick you or fool you, unless you allow them to do so – remember that well. The more innocuous, innocent, harmless and benign a scam seems to be, the more treacherous and harmful it will be. One fails to understand the vast repercussions of the sheer hoax and fraud of these scams, until such time as one has allowed oneself to fall easy prey to it.

Everything that Glitters is not Gold. Be cautious, smart and wary.

What else is there left for me to say? Human beings are (and always will be) their own worst enemies. There is no denying this fact. What do you say?

——————————————————————————–

In conclusion:

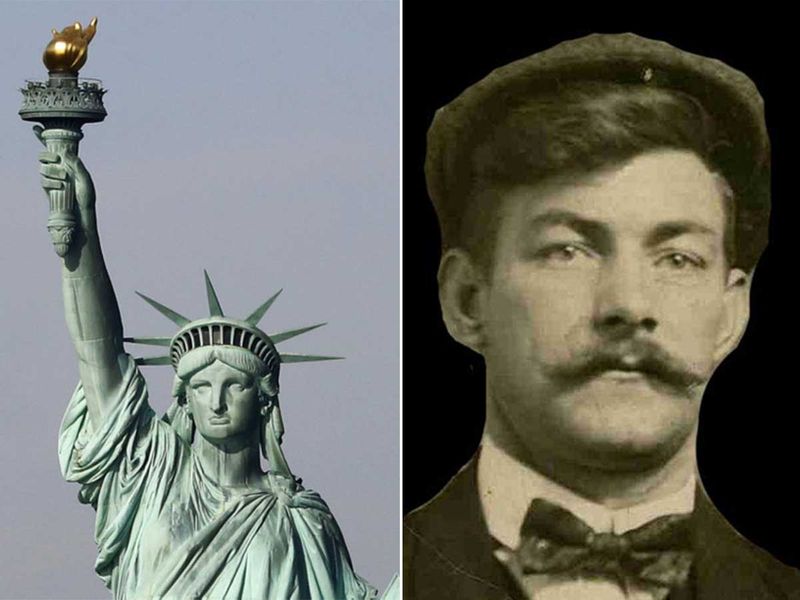

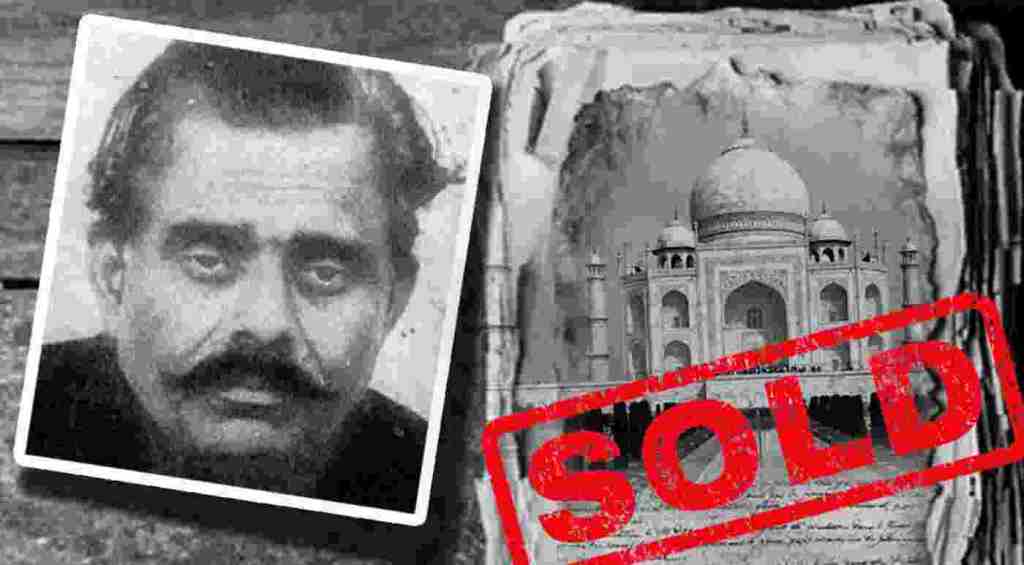

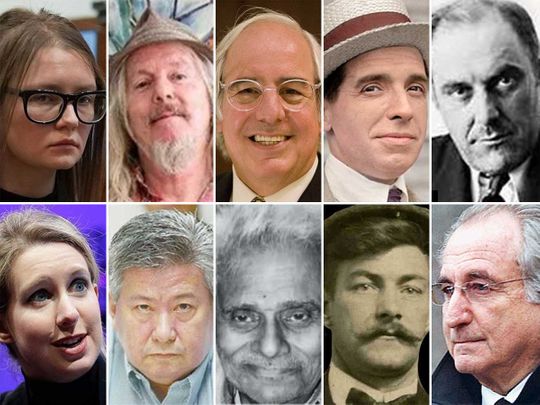

Meet the world’s most cunning con artists

Capable fraudsters combine psychology and subtle schemes to lure their target

Source: https://gulfnews.com/photos/news/meet-the-worlds-most-cunning-con-artists-1.1633434460033?slide=1

(Image Credit: Wikipedia Commons)

(Image Credit: AP)

——————————————————————————————————————-

I believe that there are individuals who have lost their crypto one way or the other. I strongly advise that you don’t seek help recovering it online because you are likely going to meet a scammer who will steal more of your funds in an attempt to help you recover your lost crypto. I personally have used ExpressHacker99 when I had to recover my bitcoin stolen by scammers. You can contact this legit recovery firm by email (expresshacker99 via gmail [.] com).

LikeLike

Thanks for sharing this important information, Deborah!

LikeLike

Thank you for this information, Deborah!

LikeLike